XBRUSD Teknik Analizi Brent petrol fiyatlamalarında resesyon endişelerine bağlı talebin azalacağına yönelik beklentiler ile satış baskıları arttı…

2020-03-20 • Güncellendi

The market is behaving in a rather unusual fashion these days. Below we have gathered the main characteristics of the new trading environment. Check them out in order to be prepared and make good trading decisions.

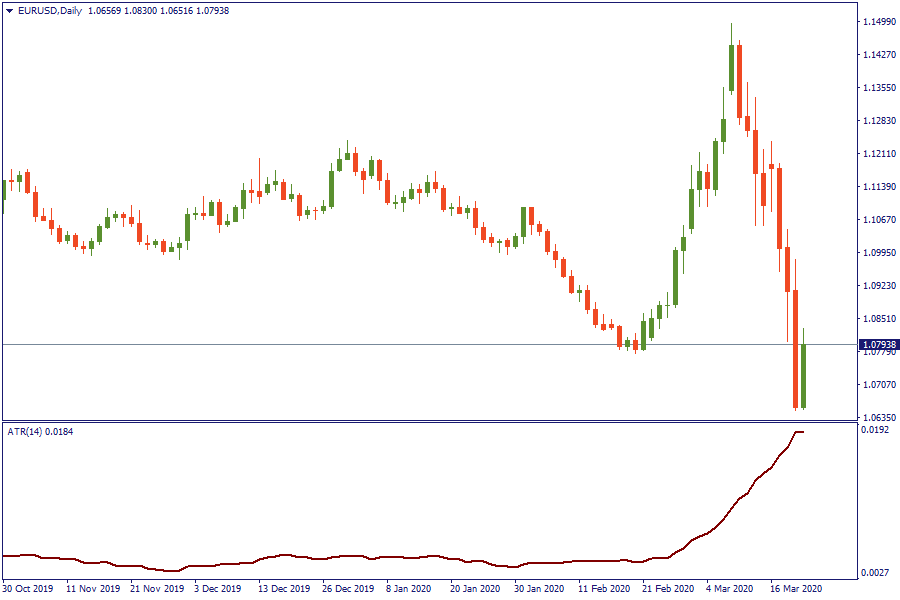

If we compare the typical daily range of EUR/USD last year and this year using the Average True Range indicator (ATR), we’ll see an immense spike in volatility. In other words, in 2020 EUR/USD – and other currency pairs – makes bigger daily moves than usual. Overall, this is good news for traders: more pips can give a bigger profit. It’s necessary to keep in mind this new feature of the market while choosing the place for Take Profit and Stop Loss orders.

In textbooks about fundamental analysis, you will definitely see a classic example: a central bank cuts interest rate and the exchange rate of this country’s currency goes down. However, when the Federal Reserve made its last rate cut, the USD went up. The greenback strengthened because investors were stressed by the coronavirus and wanted to have it as a safe haven no matter what. The demand for the USD was higher than usual and that led to a shortage of dollars in the global financial system. As a result, the USD strengthened even more. This shows that although a trader has to know the classic economic relations, he/she also needs to adapt to the current situation.

The current fundamental background is complicated. There are several factors in play, the major ones being the coronavirus and the disagreement between Saudi Arabia and Russia about the volume of oil output. Together, these factors create a negative picture for risk assets, such as commodities and stocks.

It doesn’t happen very often that different assets get to multiyear (or even record!) highs or lows at the same time. For example, GBP/USD tested the minimal level since 1985. USD/MXN set a record high. The market is playing with big support/resistance levels, that’s why it’s very important to look at large timeframes in order not to miss them.

When multiple assets go down, it’s worth remembering that selling is the best strategy during a downtrend and Forex market allows to do that. You can even open sell trades in stocks. As a result, it’s necessary to keep a cool had and look at the market with some detachment, i.e. objectively, in order to see the plentiful opportunities it offers.

The current situation is so complicated that there’s no point in making medium-term forecasts. Instead, the best way is to focus on the short-term price swings. Monitor the news, apply the tools of technical analysis and make use of the elevated volatility. Finally, remember about the proper risk management. May the profit be with you!

XBRUSD Teknik Analizi Brent petrol fiyatlamalarında resesyon endişelerine bağlı talebin azalacağına yönelik beklentiler ile satış baskıları arttı…

Ham Petrol Teknik Analizi Haftanın en önemli gelişmelerinden olan FED faiz kararı takip edilirken, beklentiler dahilinde FED ‘agrasif’ bir adım attı ve 75 baz puanlık faiz artış yoluna gitti…

XBRUSD Teknik Analizi Brent Petrol’de Çin’deki önlemlerin gevşetilmesi ve talebe yönelik olumlu seyir tekrardan canlanması fiyatlamalara yansıyor…

GBPUSD paritesinde 1…

USDTRY paritesinde alıcı iştahı devam ediyor ancak kritik bir direnç alanına yaklaştık…

Altında Powell Etkisi Yükselişleri Destekledi Ons altın Fed Başkanı Powell'ın faiz artış hızını düşürebileceğine işaret eden açıklamalarıyla yükselişini ikinci güne taşıdı…

FBS bu web sitesini çalıştırmak için verilerinizin kaydını tutar. “Kabul Et” düğmesine basarak, Gizlilik politikamız kabul etmiş olursunuz.

Talebiniz kabul edildi.

Bir yönetici sizi kısa süre içinde arayacaktır.

u telefon numarası için bir sonraki geri arama talebi

sonra olabilir

Eğer acil bir sorununuz varsa lütfen bizimle iletişime geçin

Canlı sohbet

İç hata. Lütfen daha sonra tekrar deneyiniz

Zaman kaybetmeyin - TDİ'nin ABD Dolarını ve kârı nasıl etkilediğini takip edin!