Ask yourself this: what’s the point of making money in one trade and losing it all in the next? Pro traders know that staying in the game means protecting what they have. That is the only way to become profitable.

The next step in your journey is risk management.

What risk management is and how it helps traders

“Risk management is your radar, your life jacket, and your emergency plan."

Risk management helps you limit losses and protect your capital so you don’t wipe out your entire account on a single bad trade. Even professional traders lose trades—it’s part of the game. But they manage their risk well, so their losses don’t hurt them too much.

Here are some tools you’ll use for risk management:

Stop-loss (SL):

think of this order as your emergency brake. When you set a stop-loss order, you are secured. It is the price of an instrument at which the trade will be closed automatically.

Take-profit (TP):

the opposite of stop-loss. It’s an order that automatically closes your trade when the asset reaches a certain profit level. This way, you lock in gains without having to watch the market all the time.

Here’s a table explaining both tools.

Term | Description | Purpose | Where traders put it |

Stop Loss (SL) | An order that automatically closes your trade to limit losses. | Minimizing risk if the trade went bad. You can achieve better results with more control. | Below entry price for buy trades; above for sell trades. |

Take Profit (TP) | An order that automatically closes your trade when a certain profit level is reached. | If the trade goes well, it ensures profits. | Above entry price for buy trades; below for sell trades. |

With stop loss, you can risk the predetermined sum. No stress, no panic.

How to calculate your profits and losses

Points, Lots, and Leverage.

You need these trading terms to calculate your trade size, and ultimately, to control your trading.

Term | Definition | Example |

Point (Pip) | Smallest price movement in forex. For 0.01 lot of EURUSD, a movement of 1 point equals $0.01. For 0.1 lof of EURUSD, 1 point equals $0.1, and for 1 lot it equals $1. 10 points = 1 pip. | EURUSD moves from 1.12340 to 1.12350 (10 points or 1 pip). |

Lot | Size of trade (standard lot is 100 000 units) | You buy 1 lot of EURUSD = 100 000 EUR |

Leverage | Control bigger positions with small capital. Multiply leverage by the money in your account to know the maximum trade size you can open. | 1:1000 leverage means you can open a $100 000 trade with $100 of actual capital in your account ($100 of your money x 1000 leverage = $100 000) |

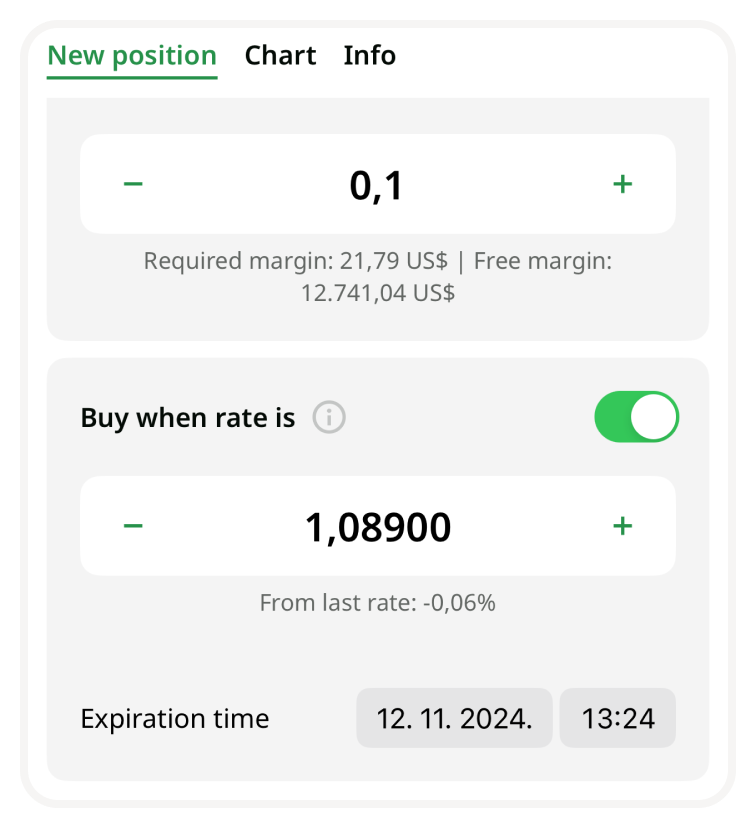

When calculating your profit, you can use the New Position tab in the FBS app (shown below). You can also use the Trading Calculator on the FBS website.

Let’s break it down with an example:

You buy 1 lot of EURUSD at 1.10000 with a 100-point stop-loss and a 200-point take-profit. That means the trade will be closed automatically if the price falls 100 points (because of stop-loss) or rises 200 points (because of take-profit).

From the table above, you know that “for 1 lot of EURUSD, a movement of 1 point equals $1.”

If the trade hits your stop-loss, you’ll lose $100. You can get this number by multiplying $1 per point and 100 points before your SL activates.

But if it hits your take-profit, you’ll gain $200 ($1 per point multiplied by 200 points before your take-profit is hit).

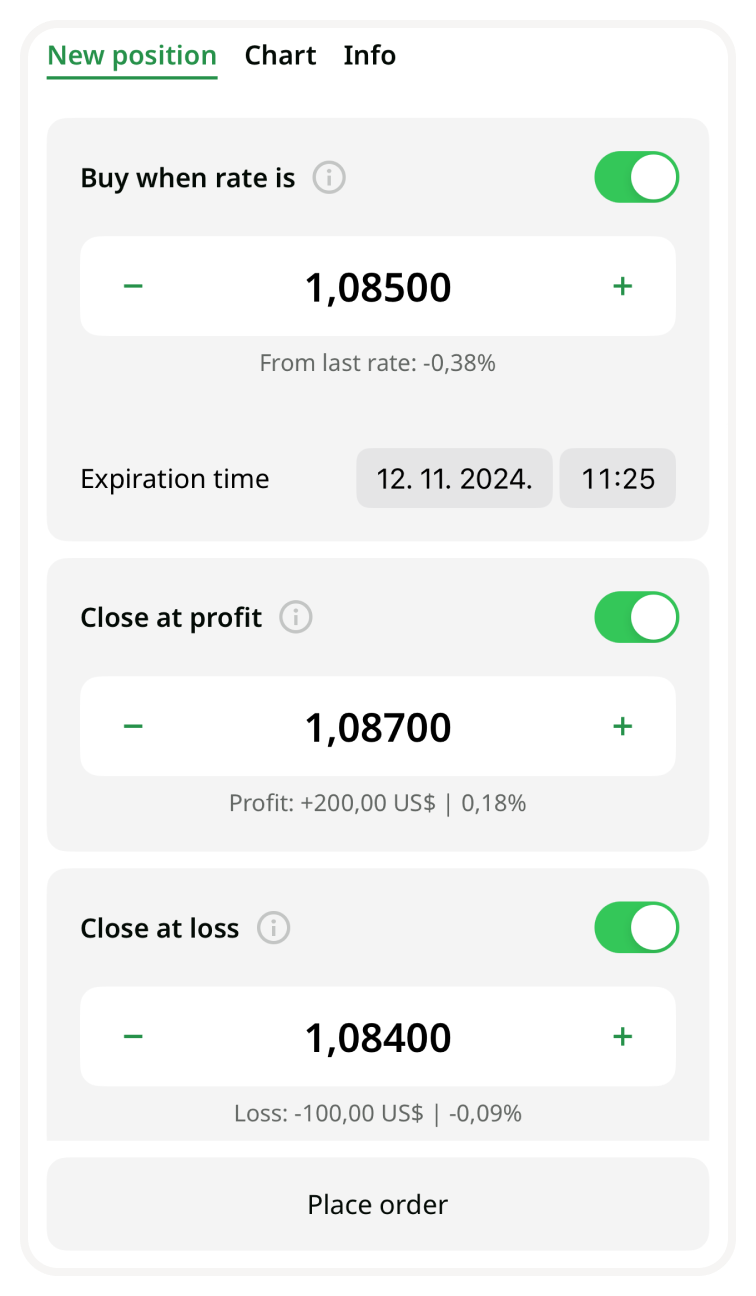

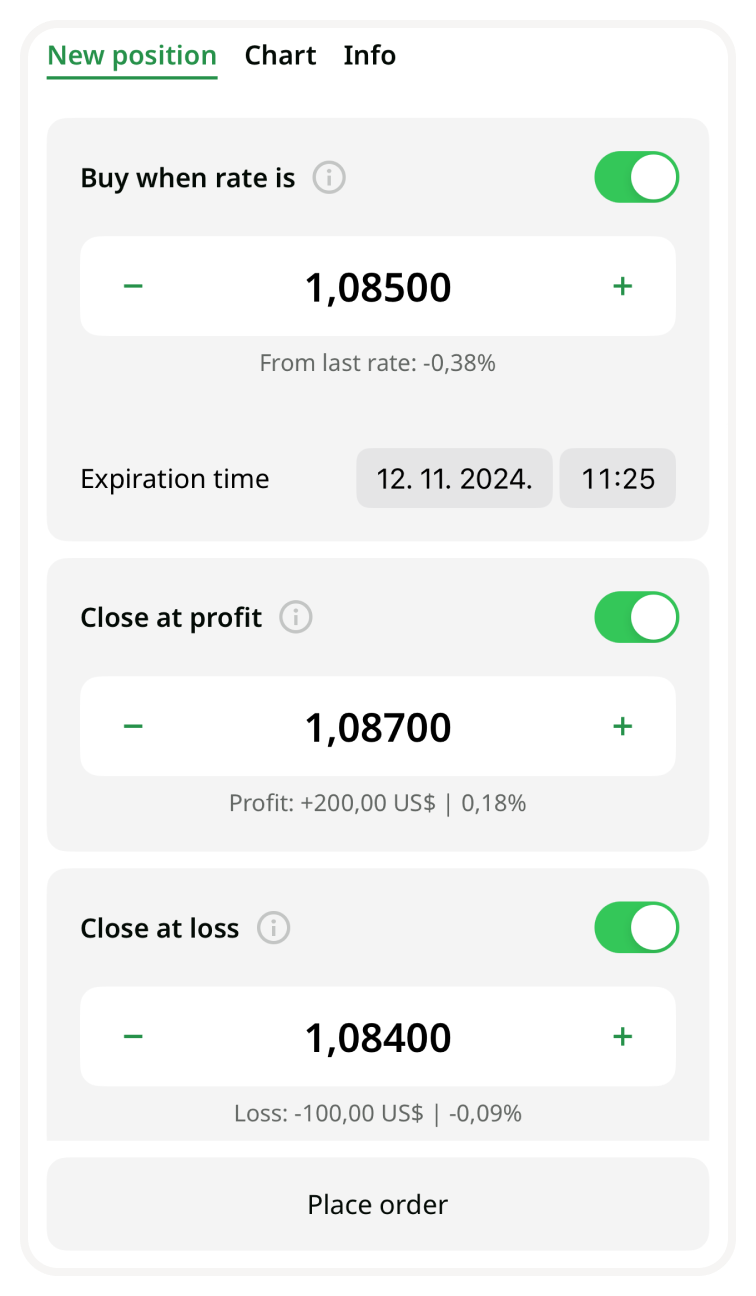

In the figure below, you see the example of a profit calculation. A trader wants to buy 1 lot of EURUSD at a price of 1.08500. You can see the “Buy when rate is” switch turned on. We will explain it in this lesson.

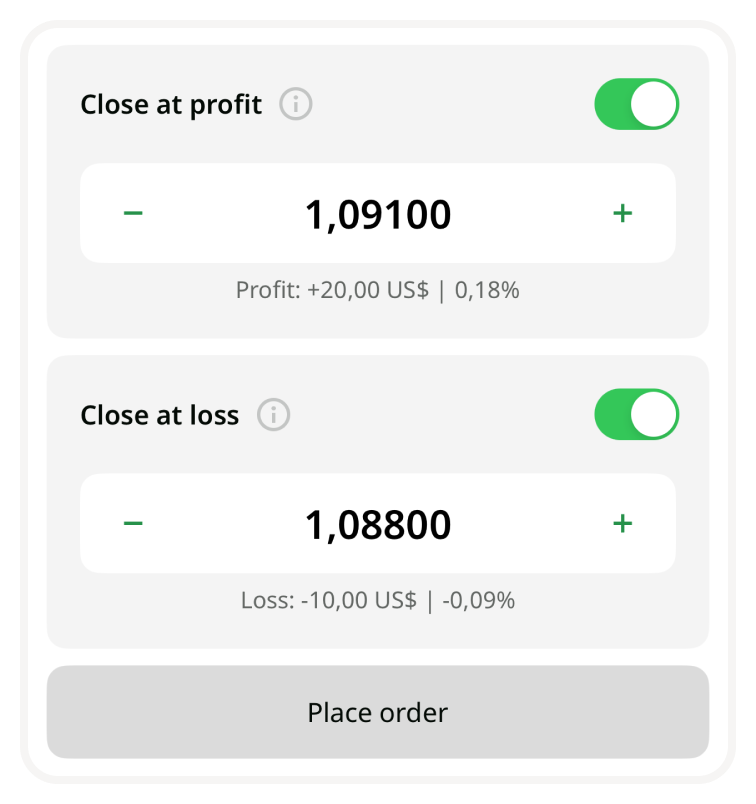

The “close at profit” price is the take-profit. It’s set at the price of 1.08700 (200 points above the entry price). The distance of 200 points means the trader will get $200 if the trade goes well.

The “close at loss” price is the stop-loss. It’s set at the price of 1.08400 (100 points below the entry price). The distance of 100 points means the trader will lose $100 if the trade goes badly.

Always calculate how much you can afford to lose before entering a trade. You’re aiming for a profit-loss ratio of at least 1:2, meaning your potential profit should be at least twice the size of your potential loss.

Imagine you think you’ve got a ‘100% accurate trade’ and you put all your funds into it. The market turns against you. In seconds, your account is wiped out. Not a fun feeling, right?

You should only risk a small percentage of your account (1-5%) on each trade. Even if the trade goes wrong, you live to trade another day.

The essentials of a trading strategy

Now that you know how to manage risk and calculate your profit and loss, it’s time to talk about strategy. We will explain different types of strategies and open a trade using all the knowledge from this lesson.

Let’s look at some popular strategies:

Trend following. As the saying goes, “The trend is your friend.” In this strategy, you identify a strong upward or downward movement and follow it by opening trades in the same direction. Once the trade is open, you can stay in it for a long time, and if the trend persists, your profit may increase. The question is when to exit such trades before the price starts to drop.

Breakout strategy. You wait for the price to "break out" of a key level of support or resistance. When that happens, you expect a solid movement and then close the trade. We don’t cover support and resistance lines in this course, so check our tutorial for that.

Let’s say EURUSD is in a strong uptrend, meaning the price is going up. Usually, traders wait for the price to fall slightly, and then enter a buy position. Traders wait to get a better entry point and increase their chances for a successful trade.

This is what you might do as a trader:

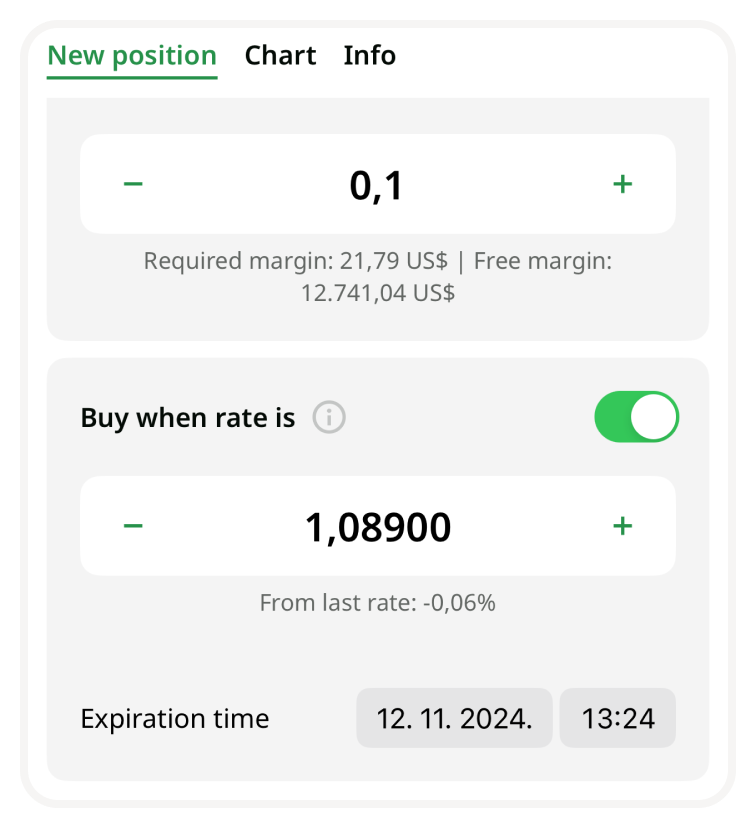

- Open the EURUSD chart and wait for the preferable entry point. It can be anything, so let’s assume you want to enter at the price of 1.08900.

- You click Buy and see a “New position” page. Here, you can change your order size. Let’s choose a 0.1 lot as an example. Each point here equals $0.1 (remember the calculations above).

- Turn on the “Buy when rate is” switch. It gives you the ability to open a trade on the price you want. Of course, you would need to wait for the price to reach this point. This is extremely helpful if you want to calculate your trade precisely.

- Set the value at 1.08900.

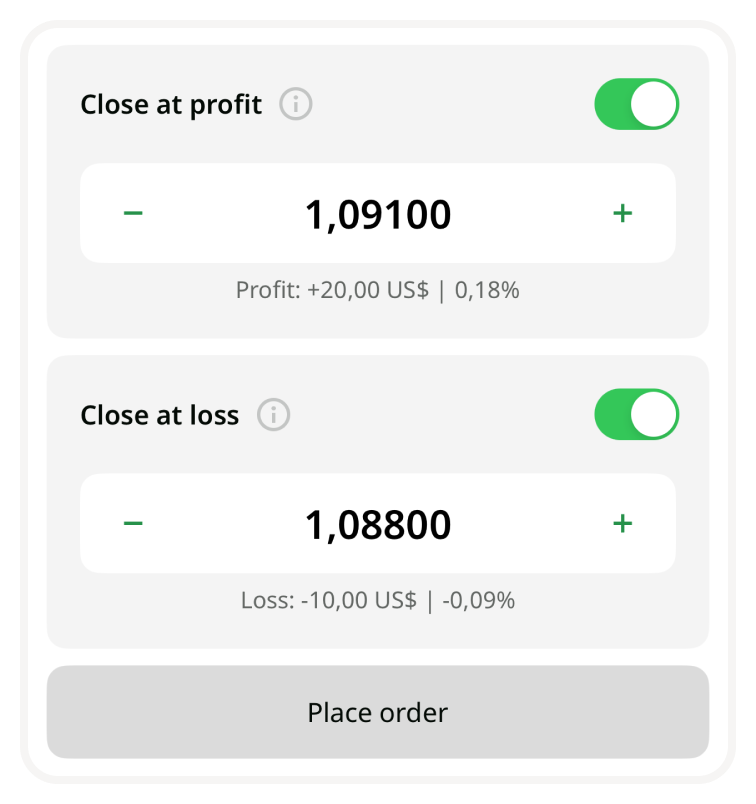

- Turn on the “Close at profit” switch. That’s your take-profit. Choose the value for which your profit would be $20. This value is exactly 200 points away from your entry price. Your take-profit will be 1.08900 + 0.00200 = 1.09100 (a point is the last digit in the price, so 200 points is 0.00200).

- Turn on the “Close at loss” switch. That’s your stop-loss. Choose the value for which your loss would be $10. This value is exactly 100 points away from your entry price. Your stop-loss will be 1.08900 – 0.00100 = 1.08800 (100 points is 0.00100).

Tap the Place order button.

Congratulations! You’ve just made a well-planned trade!

Homework

Homework: Open the FBS app and execute your next trade like a pro. Use everything you’ve learned.

Find the GBPUSD pair in the app.

Find a place where you want to open a trade.

Set a trading volume of 0.1 lot.

Set your take profit 200 points away.

Set your stop loss 100 points away.

Open a trade.

Return to your trade later to check on it.

Remember, risk only what you’re willing to lose, even in a demo account — that’s how to think like a pro trader.