Global markets soared on Thursday after reports surfaced that China plans to inject billions of dollars into its economy, specifically targeting state-owned banks. This move is expected to help strengthen the Chinese financial sector and counter the country's economic slowdown. The news caused futures for the S&P 500 and Dow Jones to rise, with the S&P gaining 0.8% and the Dow increasing by 0.4% in pre-market trading. Chinese markets responded strongly, with the Hang Seng in Hong Kong jumping 4.2%, and the Shanghai Composite gaining 3.6%. Asian markets followed suit, with Japan's Nikkei 225 up 2.8% and South Korea's Kospi rising 2.9%, partly fueled by optimism in the tech sector as semiconductor company SK Hynix announced new AI-related products. European markets also saw gains, with Germany's DAX and France’s CAC 40 both climbing over 1%. Meanwhile, U.S. oil prices dropped for the second day in a row, dipping below $70 a barrel amid reports that Saudi Arabia may increase oil production, signaling a shift in its pricing strategy. In contrast, Amazon and Tesla share prices appear to have reached a crucial turning point.

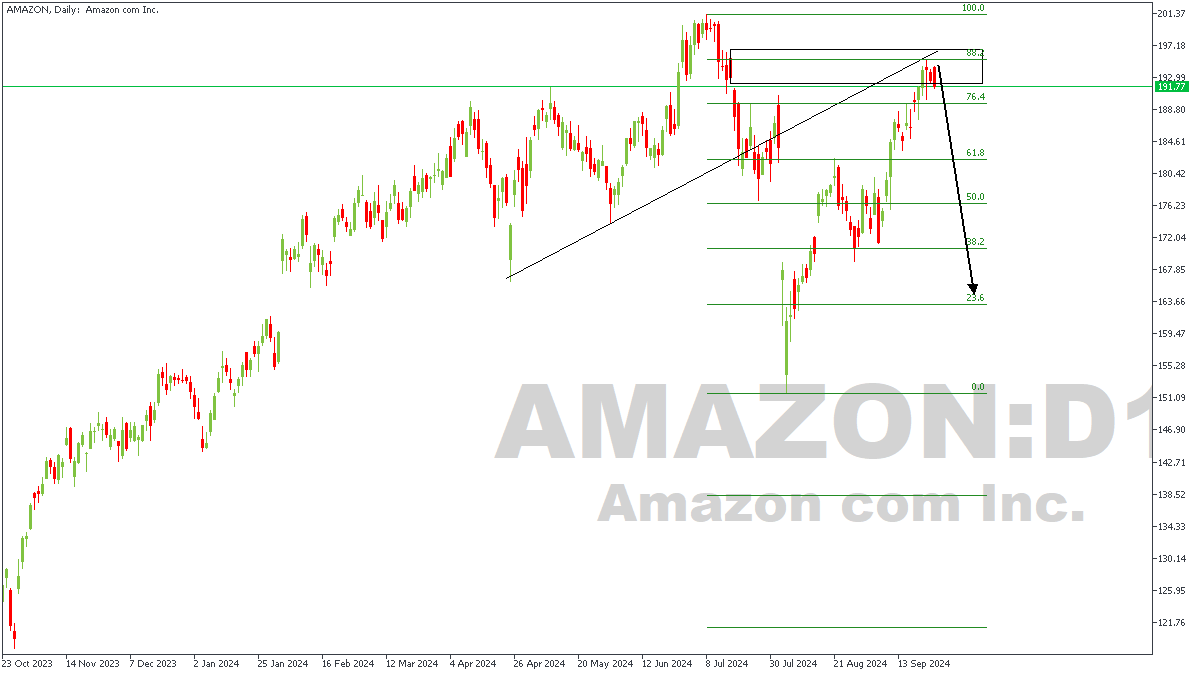

AMAZON – D1 Timeframe

Amazon on the Daily timeframe is currently trading away from the supply zone at the 88% of the Fibonacci retracement, with the trendline resistance serving as a crucial confluence in favor of sustained bearish momentum. My expectation here is that price would aim for the Fair Value Gap (FVG) at the $182 price point.

Analyst’s Expectations:

Direction: Bearish

Target: 182.58

Invalidation: 200.45

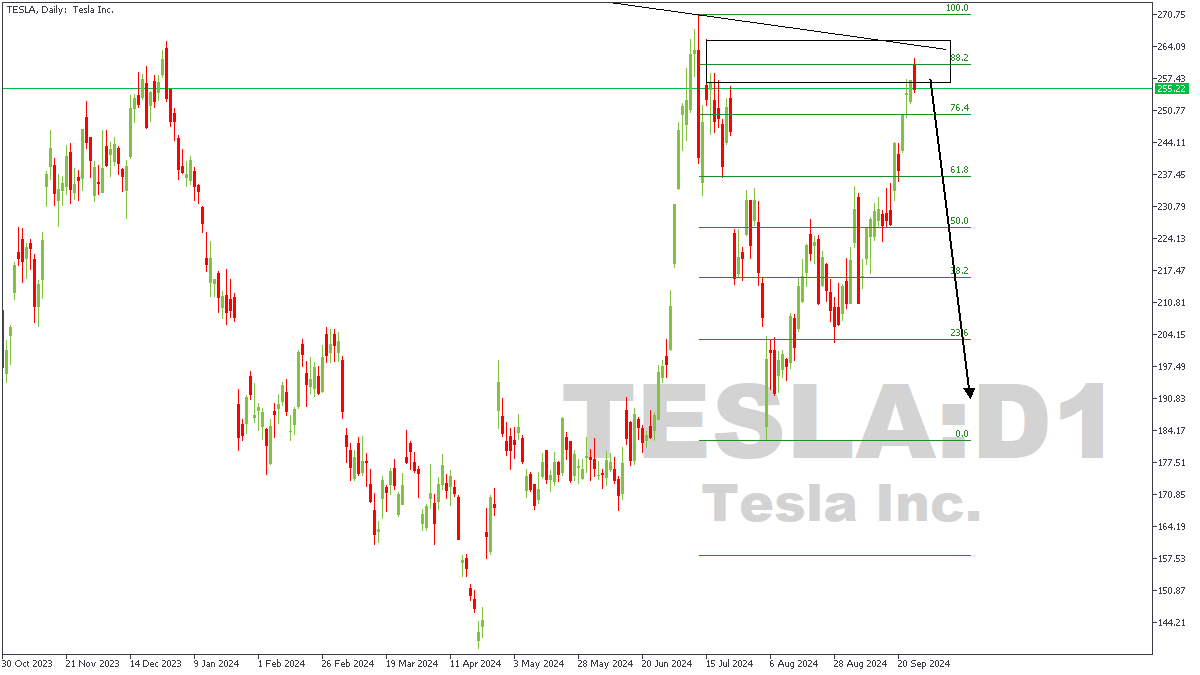

TESLA – D1 Timeframe

The current price action on the daily timeframe of Tesla shares shows price trading away from the 88% of the Fibonacci retracement tool. The rejection enjoys further confluence from the trendline resistance and seems to be heading towards the $230 price region as its initial profit target.

Analyst’s Expectations:

Direction: Bearish

Target: 236.86

Invalidation: 271.14

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.