The S&P 500 was down 0.4% by midday on Thursday, after shifting between small gains and losses earlier in the day. It's been a shaky week for the index, partly due to concerns about rising tensions in the Middle East. The Dow Jones was down 273 points (0.6%), and the Nasdaq also dropped 0.3%.

Oil prices jumped, with Brent crude rising 3.9% to $76.80 per barrel, as the market waits to see how Israel will respond to Iran’s missile attack earlier this week. Iran is a major oil producer, and there are concerns that a broader conflict could impact oil supply in the region.

In the bond market, Treasury yields increased after reports showed that the U.S. services sector grew faster than expected. Even though the number of layoffs remains low, hiring trends have slowed, raising questions about the job market's future. Investors are also watching for new economic updates and any further interest rate cuts by the Federal Reserve.

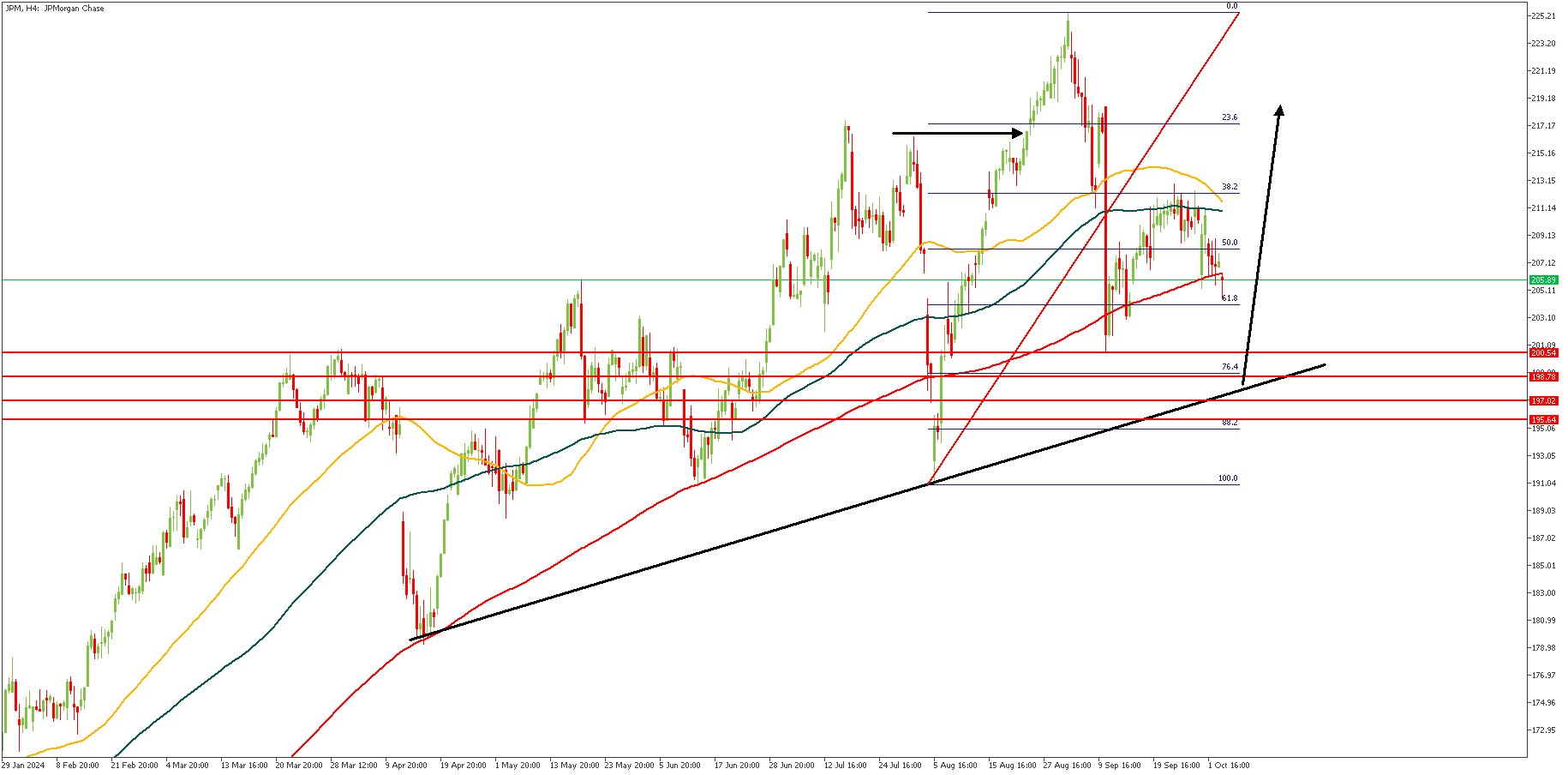

JP MORGAN – H4 Timeframe

The 4-hour timeframe chart of JP Morgan share price has notably been in an uptrend for a while. This is followed by the recent break above the highlighted high. Based on the bullish array of the moving averages, the pivot around the 76% of the Fibonacci retracement tool, and finally, the trendline support, it is my expectation to see price bounce off the confluence of the demand zone and the trendline support.

Analyst’s Expectations:

Direction: Bullish

Target: 217.14

Invalidation: 191.01

MICROSOFT – H4 Timeframe

.png)

The 4-hour timeframe chart attached above shows price currently approaching the confluence region of a demand zone, and a trendline support after having broken above the previous high as highlighted. As a result of this, it is my expectation that price would most likely get rejected off the confluence region in order for price to resume its bullish momentum.

Analyst’s Expectations:

Direction: Bullish

Target: 440.25

Invalidation: 397.27

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.